how to pay indiana state withholding tax

The county tax rate will depend on where the employee resided as of January 1. The initial state withholding taxes are based on published guidance from each state lottery and the final state tax rates are from state government publications.

State W 4 Form Detailed Withholding Forms By State Chart

From the Item Name list select Indiana Counties Tax.

. If you have specific questions about a bill call our payment services team at 317 232-2240 Monday through Friday 800 am. Pay my tax bill in installments. Annuitants Request for State Income Tax Withholding.

Businesses in the construction industry pay a higher starting rate The new employer rate usually remains in effect for at least 36 months. Residents of Indiana are taxed at a flat state income rate of 323. Transporter Tax TRP.

430 pm EST. Complete the county tax breakdown portion on the reverse side of the WH-1 and check the box on the front of the form indicating you have completed the reverse side. This penalty is also imposed on payments which are required to be remitted electronically but are not.

Almost all gambling winnings are subject to this tax. That means no matter how much you make youre taxed at the same rate. 99999 99999 999 or 99999 99999 999 9 13 or 14 digits.

Know when I will receive my tax refund. Account Numbers Needed. Pay my tax bill in installments.

If you have any questions about the withholding of state or county taxes please contact the department at 317 232-2240. Casinos typically withhold 25 of your winnings for tax purposes. Your average net per year.

INTAX only remains available to file and pay special tax obligations until July 8 2022. All counties in Indiana impose their own local income tax rates in addition to the state rate that everyone must pay. File my taxes as an Indiana resident while I am in the military but my spouse is not an Indiana resident.

Departmental Notice 1 explains how to withhold taxes on employees. If you have not filed the return select File Return from the Payment Confirmation page. Companies who pay employees in Indiana must register with the IN Department of Revenue for a Taxpayer ID Number and the IN Department of Workforce Development for a SUTA Account Number.

1 2022 A county with an asterisk has changed. Indiana County Tax Rates Effective Jan. INtax supports the following tax types.

Employees Withholding Exemption County Status Certificate. INtax only remains available to file and pay the following tax obligations until July 8 2022. Send in a payment by the due date with a check or money order.

Accessing from Employee Center. Click the Annual Payment Schedule link next to the state. These are state and county taxes that are withheld from your employees wages.

Know when I will receive my tax refund. Be aware that closing a business with DOR does not end your obligations to. File my taxes as an Indiana resident while I am in the military but my spouse is not an Indiana resident.

323 state tax - 265937 - 4541380. Leave the entry blank if the dollar amount is 0. Failure to file a tax return.

Find Indiana tax forms. Claim a gambling loss on my Indiana return. Print this page for your records.

Businesses can close their tax accounts on INTIMEIf a business does not have an INTIME account then it is required to send an Indiana Tax Closure Request Form BC-100If the tax account isnt closed on INTIME or the BC-100 isnt filed DOR may continue to send bills for estimated taxes. Take the renters deduction. Currently Indianas personal income tax rate is 323.

Find Indiana tax forms. Fraudulent intent to evade tax - 100 penalty. Taxpayers pay the tax as they earn or receive income during the year.

Take the renters deduction. Be sure that the total amount withheld on the county breakdown on the reverse of the WH-1 matches line 2 on the front of the form. A Payment Confirmation page displays after the payment has been submitted successfully.

Special Fuel - SFT. Depending on the tax type INtax may populate the form with information or you may have to choose the form type. If you decline that option they usually withhold 28.

Claim a gambling loss on my Indiana return. That is only the norm if you provide them with your social security number however. When you receive a tax bill you have several options.

Failure to pay tax - 10 of the unpaid tax liability or 5 whichever is greater. Gasoline Use Tax GUT. The Indiana Department of Revenue DOR is transitioning tax accounts to its new online e-services portal INTIME which currently offers the ability to manage most tax accounts in one convenient location at intimedoringov.

If an employee resides out of state on January 1 but has his or her principal place of work or business in an Indiana county the withholding agent should withhold for. INBiz can help you manage business tax obligations for Indiana retail sales withholding out-of-state sales gasoline use taxes and metered pump sales as well as tire fees fuel taxes wireless prepaid fees food and beverage taxes and county innkeepers. These tables divide the dollar amount of the exemptiondependent exemption by the number of pay periods.

For the feds. Annual Nonresident Military Spouse Earned Income Withholding Tax Exemption Form. Have more time to file my taxes and I think I will owe the Department.

Bad checks - A flat 35. Have more time to file my taxes and I think I will owe the Department. Failure to file a tax return.

IN Taxpayer ID Number. If you have employees working at your business youll need to collect withholding taxes. If you are mailing your Indiana return the complete filing instructions.

However in recent years the rate has been stable at 25. This is where youll begin the INtax registration process. Apply online using the IN BT-1 Online Application and.

Option 2 is through Payroll Setup. Preparation by Department - 20 penalty. Starting with the 2018 tax year Form IL-941 Illinois Withholding Income Tax Return.

Up to 25 cash back The state UI tax rate for new employers also known as the standard rate also may change from one year to the next. Motor Fuel - MFT. Contact the Indiana Department of Revenue DOR for further explanation if you do.

Registration for withholding tax is necessary if the business has. Indiana counties local tax rates range from 050 to 290. The Indiana Department of Revenue DOR is transitioning tax accounts to its new online e-services portal INTIME to offer the ability to manage tax account s in one convenient location 247.

Indiana businesses have to pay taxes at the state and federal levels.

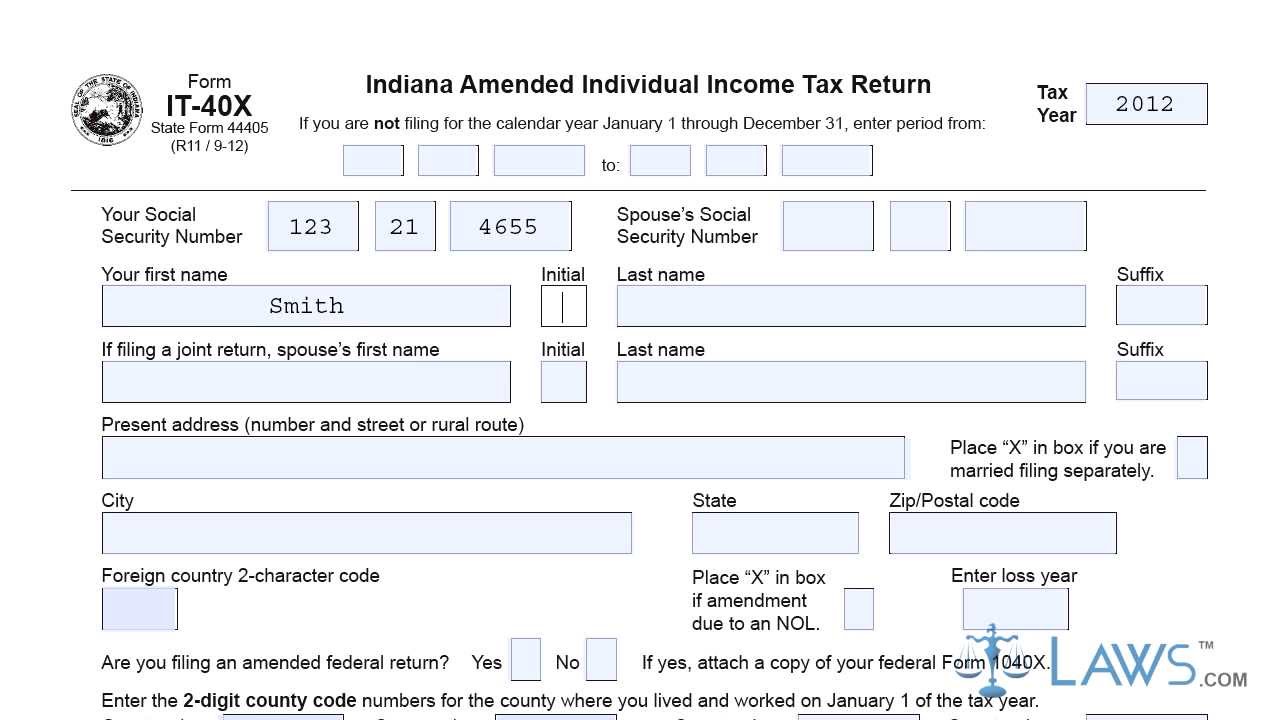

Form It 40x Indiana Amended Individual Income Tax Return Youtube

How Taxes Work Taxes Social Security Numbers Visas Employment Office Of International Affairs Indiana University Purdue University Indianapolis

Indiana Taxes For New Employees Asap Payroll Services

State Of Ohio Refund Cycle Chart 2014 29 Louisiana State Tax Forms Picture Louisiana State Tax Forms State Tax Chart

State W 4 Form Detailed Withholding Forms By State Chart

Free Indiana Payroll Calculator 2022 In Tax Rates Onpay

Get Our Printable First B Notice Form Template Templates Form One

Purdue University Degree Pu Diploma Buy Fake Purdue University Degree Buy Fake Pu Diploma University Degree Free Certificate Templates Usa University

Dor New To Intime Here S How To Get Started

A Basic Overview Of Indiana S Wh 4 Form For State Tax Withholding

Dor Owe State Taxes Here Are Your Payment Options

W 2 Form For Wages And Salaries For A Tax Year By Jan 31

Minnesota Department Of Revenue Minneapolis Mn Mm Financial Consulting Minneapolis Lettering Letter I

Solved Indiana Withholding Setup In Quickbooks Payroll

Irs Installment Agreement Chicago Il 60647 Mm Financial Consulting Inc Chicago Internal Revenue Service Lettering

New Filing Requirements In Connecticut Welcome To 1099 Etc Com Connecticut Oklahoma Flag Oklahoma Usa

Irs Taxes Payment Plan Darien Il Www Mmfinancial Org Irs Online Taxes Tax Payment Plan